24/7, near real-time, always-on infrastructure: Citi transforms transaction banking services with Besu

Citi Token Services for Cash:

● Provides real-time USD payments and rapid settlement using tokenized interbranch deposits

● Facilitates 24/7 operations for global transactions

● Provides a seamless experience for clients

Goals

- Innovate in the payments space to increase capabilities

- Integrate blockchain technology with existing banking infrastructure

- Address the challenges of cross-border payments

- Securely and transparently automate financial processes

Approach

1. Vet a new technology

2. Find the ideal use case

3. Choose the correct framework: Besu, a Linux Foundation Decentralized Trust project

4. Build the underlying platform

5. Rollout your first solution

Results

- Improved Transaction Speed: Transactions that took days now get completed in near real-time

- Seamless Client Experience: Transfers are made through existing channels, with no need for clients to hold tokens

- Increased Efficiency: Transactions can occur anytime, across borders and time zones

- Efficient Integration: The platform has been connected to multiple Citi systems in the first year of its rollout

- Industry Recognition: Awarded the 2024 Model bank Award for Digital Asset Innovation by Celent, a global research and advisory firm for the financial services industry

Introduction

If you use a money-transfer app to repay your friends for the movie tickets they bought, it may seem like moving money is easy.

Yet at an enterprise level, moving money and assets is often slow and complex, especially across borders.

Treasury and finance departments can struggle to manage their working capital because currency cut-off times and limited bank services outside regular hours–which depend on time zones–make it hard to move money around globally.

Trade financing is also challenging. Many businesses still use paper documents and manual processes. These transactions can take days to complete as documents get reviewed, approved, signed, and shuffled around. The process isn’t always transparent and could be subject to errors.

When distributed ledger and smart contract technologies emerged, they promised transparency, efficiency, immutability, and near-instant transactions. But would it last? Could it provide a practical, large-scale application in a highly regulated, diverse global industry like finance?

“Citi Token Services and Citi Integrated Digital Assets Platform are two of the most significant banking innovations in decades.”

Vetting a new technology

A centuries-old, venerable financial institution isn’t the first organization that leaps to mind when you think about digital technology leaders.

Yet from being an original investor in the first transatlantic cable to installing the first ATM in the United States, Citi hasn’t shied away from technological innovations.

So, it isn’t surprising that the organization began vetting distributed ledger technology (DLT) before it became a buzzword. Early on, Citi saw blockchain’s potential to address long-standing challenges in financial markets.

“Our experimentation with DLT goes back a long time,” says Biser Dimitrov, Global Head of DLT Center of Excellence. The DLT Center of Excellence is responsible for developing best practices and setting standards and policies for DLT firm-wide.

“But at the time, the technology wasn’t mature enough for us to develop a project,” Dimitrov continues.

So, over the next decade, Citi monitored and experimented with the technology. This foresight and persistence gave Citi valuable insights as the technology evolved and matured.

Still, the journey from experimentation to implementation was complex. The ideal use case for Citi needed to align technical capabilities with client needs.

“These technologies set us up for continued interoperability within our systems so we can serve our clients well into the future."

Finding the ideal use case

The technical capabilities were the first to get there. But the highly regulated, risk-averse financial industry needed time to get comfortable with the longevity and security of this new technology.

This was true not only for the broader financial industry but also for the broader Citi organization.

Inside the DLT Center of Excellence and Citi Innovation Labs, the team had nearly a decade of experience. It knew blockchain could transform banking with real-time, transparent, programmable, and secure transactions. But that knowledge was siloed.

So, the DLT team shared its knowledge across the organization, educating others about the benefits of blockchain adoption for Citi’s business value.

“Our colleagues and leaders learned more, which had a flywheel effect of growing interest and support,” says Dimitrov.

As Citi’s internal acceptance of blockchain’s potential increased, the broader industry also opened up to its possibilities.

“Other major banks, including central banks, started exploring the technology, too,” says Dimitrov.

This industry-wide shift, combined with its years of testing and experimentation, placed Citi in the perfect position to launch a blockchain-based solution when the opportunity arrived.

And soon that opportunity knocked on Citi’s door.

When it did, Cit’s priorities, focus efforts, and resources converged to help its clients by developing this new instant value transfer solution: Citi Token Services for Cash.

"The scale of the project is immense. Behind it are multiple teams and subject matter experts focused on supporting this initiative. Our mission brought many people together around our common goal."

Choosing the correct framework: Besu

Versatility, interoperability, and security were paramount for Citi and the development team. The team analyzed the available options on the market.

After careful evaluation, the team chose Besu as the framework.

Besu is a project of Linux Foundation Decentralized Trust (LF Decentralized Trust). It was designed for enterprise use, yet it’s also an Ethereum client, which means it can interact with and participate in the Ethereum network.

With Besu, Citi can access Ethereum's robust public ecosystem and tools while maintaining the stronger access controls and enhanced privacy of a private network.

Like Ethereum, Besu is open source. It is hosted and openly governed by LF Decentralized Trust.

“This is an advantage because it allows us control of the source code,” Dimitrov says.

It’s also used by others in the financial industry, which creates opportunities for collaboration.

“These technologies set us up for continued interoperability so we can serve our clients well into the future," says Dimitrov.

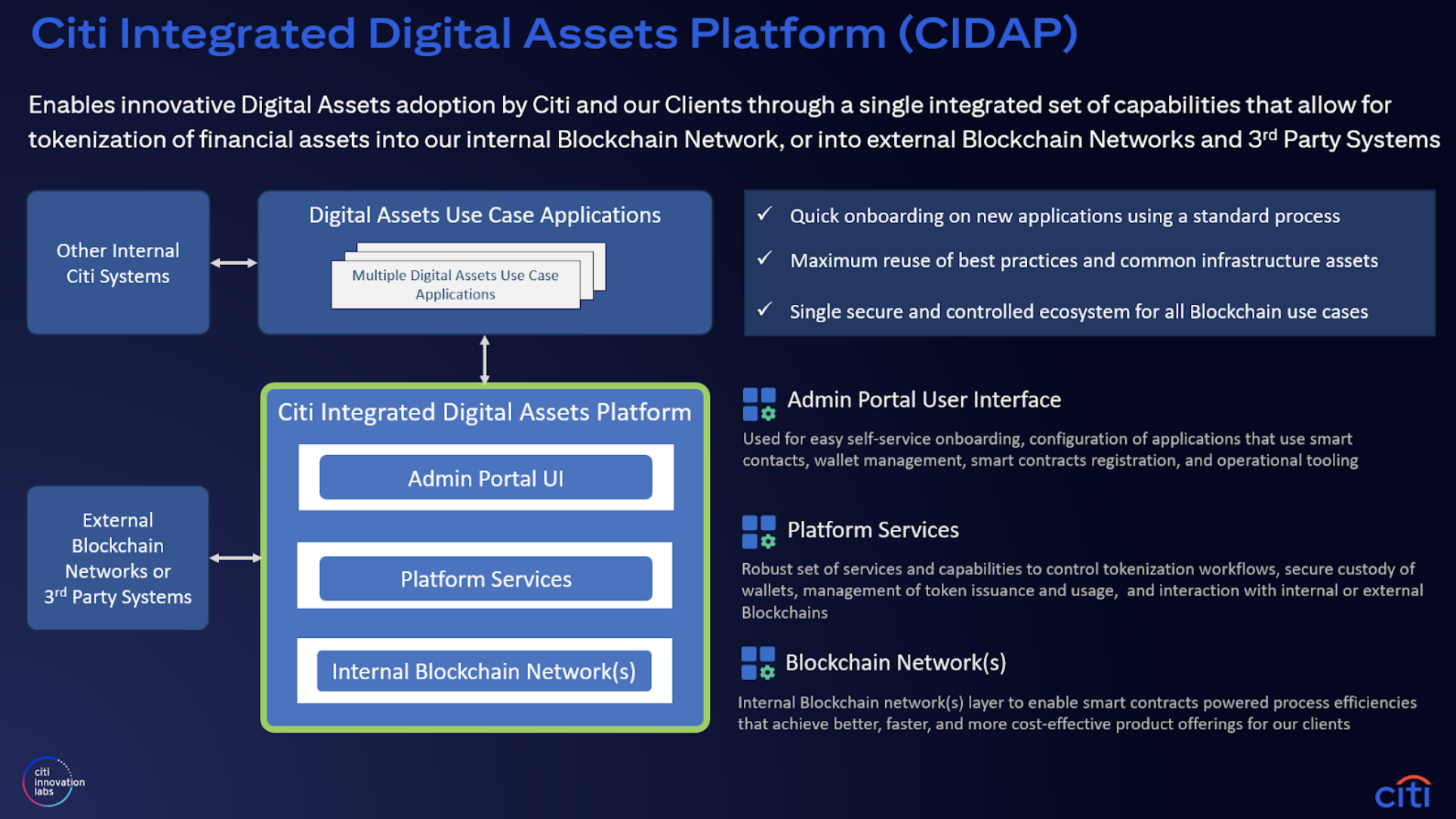

After choosing the framework, the next step was for the Innovation Labs to build a platform to house all Citi’s digital asset efforts: the Citi Integrated Digital Assets Platform (CIDAP).

“We’ll continue innovating and developing practical tools. We have a solid base for future use cases building on this foundation."

Building the underlying platform?

CIDAP is an integrated platform that enables all business lines and clients to adopt digital assets and blockchain in a consistent, cohesive, and controlled way.

Subject to internal and regulatory governance, CIDAP can provide:

- A web portal interface for dApp and web3 applications, configurations, wallet management, smart contract registration, and operational tooling.

- Reusable connectors and adapters to interface with internal Citi systems, external DLT networks (when available), Digital Assets vendors, and service providers.

- Plans for digital asset custody and wallet management service for additional tokenized digital assets.

- A robust tokenization services layer, which allows for rapid development of on-chain powered workflows to tokenize and detokenize digital assets on the internal Besu network

- Services to control and manage internal DLT network(s) through on-chain/off-chain interaction, indexing of transaction executions, and other relevant services.

- Interoperability with other target DLT networks in the future.

The team focused on optimizing the platform to handle the high transaction volumes of a global bank. This involved fine-tuning the consensus mechanism and block creation process to achieve the necessary throughput for large-scale operations.

The team also collaborated closely with all legal and compliance departments to ensure they met all necessary standards and requirements. The result was a platform that provides the audit trails, data privacy, and security measures required by internal teams and potentially by regulators across the globe.

With the foundational platform in place, the team could develop and roll out Citi Token Services.

Rolling out your first solution

Citi announced the successful testing of Citi Token Services for Cash in September 2023, which marked a turning point in finance. As of October 2024, the solution is commercially live in select jurisdictions.

“This is one of the most significant banking innovations in decades,” says Dimitrov. “You don’t introduce new transaction rails every year or even every decade.”

Citi Token Services for Cash is more than just a new tool. It redefines how global finance can work. It has several key features:

- Tokenized interbranch deposits

- Near real-time movement and settlement

- 24/7 operations

Citi Token Services for Cash also has a seamless user experience. Clients make transfers in the usual way through existing channels without needing to hold tokens.

Since Citi Token Services for Cash's rollout, Citi has seen improvements in:

- Speed and Efficiency: Transactions that once took days now happen in near real-time.

- Liquidity Management: Banks and businesses can manage their funds more effectively.

- Programmability: Clients will be able to leverage conditional transfers of funds, saving time and administrative expenses.

“The scale of the project is immense,” says Dimitrov. “Behind it are multiple teams and subject matter experts focused on supporting this initiative. Our collective mission brought so many people together around our common goal. We even attracted interest from those not working directly on the project.”

The collaborative efforts and resources dedicated to making Citi Token Services a reality haven’t gone unnoticed in the financial industry: Citi was awarded the 2024 Model Bank Award for Digital Asset Innovation by Celent, a global research center and advisory firm for the financial services industry.

As banks and financial institutions watch Citi’s progress, Citi Token Services for Cash could set the standard for the next generation of global finance.

And for Citi, the launch of Citi Token Services for Cash is just the first step into a future where banking is faster, more transparent, and more secure than ever.

What's next?

Citi’s DLT Center of Excellence is already exploring ways to expand the platform and use cases.

It’s considering incorporating additional currencies and branches to Citi Token Services for Cash, subject to internal and regulatory governance.

Additionally, Citi Token Services for Trade is in its pilot phase. It leverages the same technology as Citi Token Services for Cash but adds a smart contract layer to enable a conditional payment mechanism.

The team is also exploring using this programmability for more complex financial projects.

Another possibility is geographic expansion, where low-cost, real-time transactions could transform emerging markets.

Additionally, there are ongoing developments that could enable CIDAP to support additional capabilities and services, for instance, connectivity to additional blockchain protocols. While the platform currently uses Besu, it could potentially integrate with multiple blockchain protocols.

By enabling connectivity to both internal and external blockchain networks as well as third-party systems, the platform could provide fully integrated and highly versatile capabilities to Citi’s clients across multiple digital networks.

These solutions need time and development to ensure they can seamlessly integrate across multiple networks while retaining the very high standards of user experience, integrity and security Citi demands of its solutions.

CIDAP is designed and ready to adapt and incorporate these capabilities as they become achievable to serve the ever-evolving needs of Citi’s clients.

“As the technology continues evolving, we’ll continue innovating and developing practical tools,” says Dimitrov. “We have a solid base for future use cases building on this foundation.”

About Citi

Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in its home market of the United States. Citi does business in more than 180 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals with a broad range of financial products and services.

Additional information may be found at www.citigroup.com | X: @Citi | LinkedIn: www.linkedin.com/company/citi | YouTube: www.youtube.com/citi | Facebook: www.facebook.com/citi

About LF Decentralized Trust

LF Decentralized Trust is the neutral home for the open development of technologies that empower organizations to innovate with secure and resilient code. It is the Linux Foundation’s flagship organization for a broad range of technologies and standards that deliver the transparency, reliability, security, and efficiency required for a digital-first economy. Supported by a diverse, global base of members and communities, LF Decentralized Trust champions open source best practices across a growing ecosystem of blockchain, ledger, identity, cryptographic, and related technologies. To learn more, visit: www.lfdecentralizedtrust.org.