The National Bank of Cambodia boosts financial inclusion with Hyperledger Iroha

Bakong Project

- Sponsored by the National Bank of Cambodia, the country’s central bank

- Co-developed with Soramitsu, the main contributor to Hyperledger Iroha

- The first retail payments system in the world using blockchain technology

- The first large-scale quasi-central bank digital currency (CBDC) in production

Goals

- To reach the unbanked population, especially in rural areas

- To promote use of the national currency instead of U.S. dollars

- To reduce the liquidity and compliance burdens on payment service providers that are not banks

- To modernize retail payments to deliver better services at lower cost

Approach

- Acknowledge the country’s banking challenges

- Investigate distributed ledger technologies

- Choose the best platform to use: Hyperledger Iroha

- Design a modern, digital payments system

- Build in strong security from the start

- Test with a pilot program in the real world

Results

- During a pilot, a network of 16 banks supported 10,000+ users

- Retail throughput up to 2,000 transactions per second

- Interbank transfers improved from twice-daily batches to 5 seconds or less

- System to expand across the country in 2020

Creating a central bank digital currency (CBDC) is a journey into the unknown.

Many of the world’s central banks are looking for a way to gain all the benefits of a cryptocurrency, with none of the disadvantages.

Perhaps banks can lower the risk by taking one step at a time.

That’s what the National Bank of Cambodia (NBC) is doing. The central bank partnered with blockchain developer experts, Soramitsu to modernize the country’s legacy retail payments with the help of the Hyperledger Iroha blockchain framework.

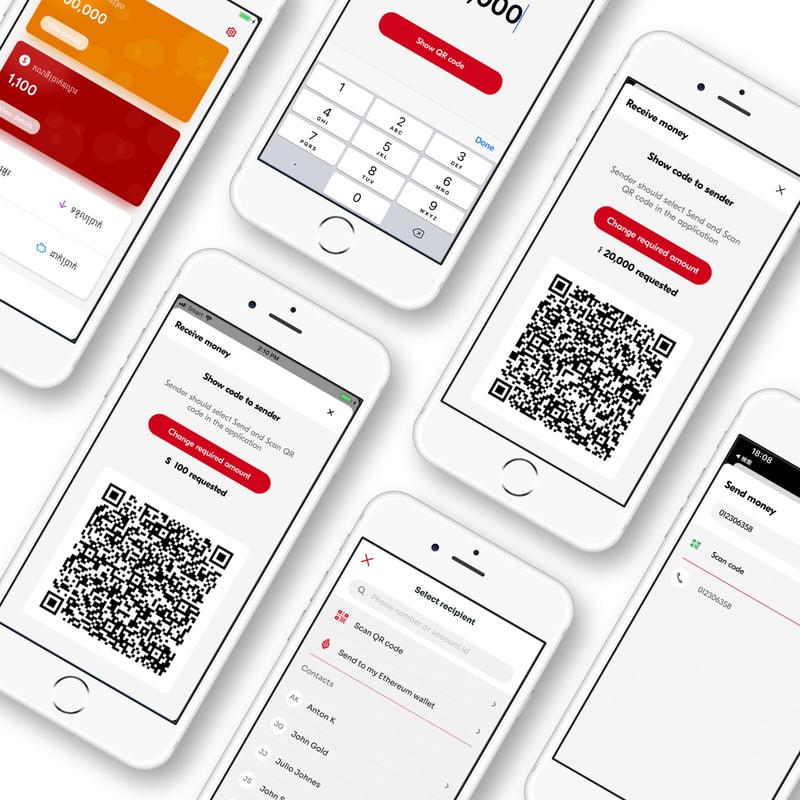

The project, called Bakong, is a smart first step that created a fiat-backed digital currency. Individuals can now transfer money and buy from merchants with a simple smartphone app. Merchants gain a fast, cashless, and secure payments system. And banks can do interbank transfers at much lower cost.

A pilot project went live in July 2019 and ran successfully with more than 10,000 users. The next step is to let everyone in the country know that the system is available and working. That makes Bakong the world’s first CBDC-like payment system.

System Graphic

Acknowledging the country’s banking challenge

In the Kingdom of Cambodia in Southeast Asia, three-quarters (78%) of its citizens have no bank account, yet more than half own a smartphone.

And even though the native currency—the Khmer riel (KHR)—has been stable for 20 years, most people there use the U.S. dollar. Ever since a major UN mission in the mid-1990s, the price of everything from a cup of coffee to a car has been given in U.S. dollars.

Converting a price to KHR involves multiplying by a factor of 4,075: not the simplest calculation to do in a busy market. For some time, the NBC had wanted to “de-dollarize” the retail segment; in other words, to regain control of the country’s currency.

Central banks tend to focus on wholesale settlements between domestic banks. But when various banks and third parties use different retail banking systems, these often don’t communicate well with one other.

The NBC wondered if distributed ledger technology (DLT) could help solve all of these problems.

Could a blockchain-based system handle transactions faster and for lower cost than the existing system? Could that promote wider use of the riel?

And could that system run as a mobile app that any citizen with a smartphone could use to shop or transfer money to family or friends?

Investigating distributed ledger technologies

When most people picture a CBDC, they imagine an entirely new digital asset created out of “thin air.” The problem is, this new asset could distort a country’s monetary policy and affect its exchange rates.

To be prudent, Cambodia’s central bank wanted to create a digital token backed by fiat currency stored safely in its vaults. The new payments platform would become a way to move around digitized cash, while preserving the creditworthiness and security of the central bank.

With a digital payments system in place, individual consumers—even the unbanked—could pay with their smartphones, merchants could rely less on cash, and banks could save costs on interbank transfers.

These were ambitious goals. In 2016, the NBC set up a working group to explore whether any technologies could help reach them.

“We aim to improve financial inclusion, efficiency and safety, as well as promote the use of our local currency,” says Her Excellency Madam Chea Serey, Director General of the NBC. “Bakong will play a central role in bringing all players in the payment space in Cambodia under the same platform, making it easy for end-users to pay each other regardless of the institutions they bank with.”

“Bakong will play a central role in bringing all players in the payment space in Cambodia under the same platform, making it easy for end users to pay each other regardless of the institutions they bank with.”

Choosing the best platform to use: Hyperledger Iroha

For a central bank, privacy is important, but anonymity is not. A guarantee that funds can only be spent once is also crucial.

The NBC was looking for a blockchain system that could provide:

- A permissioned network: For security, the central bank wanted to approve every entity on the system, with each permission having separate protocols to control the level of access.

- Confirmed transaction finality: To protect the integrity of all accounts, once a transaction was validated, it had to remain immutable.

- Byzantine Fault-Tolerance (BFT): To ensure the continuity of the system, even if one or more nodes were compromised or offline, the system needed this approach to reach consensus.

- An account management system: This would balance all accounts in the ledger with each transaction, so that the bank could easily supervise transactions.

- Simple architecture: This would give a smaller attack surface with fewer vulnerabilities to make the system easier to protect and maintain.

After defining these requirements, the central bank looked at four different blockchain platforms. Hyperledger Iroha met the bank’s requirements better than any other platform.

Hyperledger Iroha features an account-based permissioning system based on roles, and a simple architecture, with many predefined commands that save time and boost security.

For transaction finality, Hyperledger Iroha uses the Yet Another Consensus (YAC) consensus: a practical BFT algorithm based on voting for a block hash.

Using open source was another important consideration for the NBC. The quality of open source software is often better than private, proprietary software products. And a wider developer community promises more widespread testing and faster bug fixes.

“Open source motivates higher-quality code, for sure,” says Makoto Takemiya, CEO and co-founder of Soramitsu, an experienced developer of blockchain business solutions. “Everyone doing open source cares a lot more about the code they write, because they know anyone can see it.”

“Open source motivates higher-quality code. Everyone doing open source cares a lot more about the code they write, because they know anyone can see it.”

Designing a modern, digital payments system

To help build the system, the NBC chose to partner with Tokyo-based Soramitsu, a major contributor to the Hyperledger Iroha codebase.

Soramitsu worked closely with the NBC team, providing onsite support throughout the project, with developers working side-by-side with the NBC development team. This way, the team quickly resolved any open questions using well-defined and coordinated sprints.

“Having people on-site definitely helped with communication,” says Takemiya. “And it gave us new ideas for features to put in place.”

To ensure smooth implementation of Project Bakong, the platform preserves most of the features of the existing payment system called FAST. Hyperledger Iroha is an upgrade to the core system for recording financial transactions on the ledger.

The system provides modern interactions, including mobile apps for Android and iOS.

And new APIs help banks and other payment providers to integrate their core systems, internet banking, and mobile payment apps with the platform.

The platform uses the ISO 20022 standard messaging format, which makes it easy for any bank’s core system to communicate with Bakong.

And for banks without their own mobile app, the NBC provides a white-label app that participating banks can rebrand to offer instant transfers and payments to their customers.

These features keep costs low and reduce entry barriers for partners looking to join the system.

“Cambodia’s banking system consists of banks and payment service providers—these are purely technology companies that provide e-wallet and money transfer services,” says Serey. “The lighter the regulatory cost, the more payment service providers can offer affordable services to the lowest segment of the market.”

Building in strong security from the start

Soramitsu carefully integrated security into the design from the beginning.

“We follow a number of information security standards. We have a dedicated information security team performing internal reviews,” says Takemiya. “Then there are independent external reviews, which are common for these applications.”

Security reviews are usually complex and time-consuming. And they can be quite expensive, depending on how wide and deep the review goes.

Soramitsu held a number of calls with Nettitude, a third-party cybersecurity testing firm based in the UK, which works with financial institutions around the world.

After receiving documentation on the system, Nettitude created a security review plan.

“No bank, especially not the central bank, would allow any system to run without an audit and security review. Those systems are of vital importance for the organization and for the country,” says Takemiya.

“As part of the Hyperledger approval process, Nettitude performed an in-depth security review of Hyperledger Iroha,” he adds. “Next they conducted a white-box assurance test and comprehensive penetration testing in accordance with their methodology.”

As well, consultants from Deloitte audited the code, and KPMG auditors reviewed the business side of the platform. And after Nettitude completed the first security verification, the NBC performed a separate security review and audit.

The Bakong system passed all these strenuous reviews. Then it was ready for the next step: production testing.

Testing in the real world

The NBC released Bakong in a soft launch in 2019.

“It’s like a proof of concept, even though a live launch is much beyond a normal proof of concept,” says Takemiya. “Bakong has been live since July of 2019, accepting real users and real money.”

Financial institutions joined the pilot in two rounds: Acleda, FTB, Vattanac and Wing in the first round and three more in the second. Today 16 financial institutions are integrated and using the system, and more are expected to join in the near future.

The top payments and remittance provider in the country is Wing, which has over 50 locations in the capital Phnom Penh now processing Bakong transactions.

For the NBC, the purpose of the soft launch was to encourage innovation in retail payments, improve interbank transactions, and promote economic development.

“Bakong has been live since July of 2019, accepting real users and real money.”

The project was also designed to promote financial inclusion for the country’s large number of unbanked citizens. Any citizen of the country can open a Bakong account, even if they don’t have a traditional bank account.

The process works like this:

- With a smartphone and an ID, a citizen proves their identity by taking a document photo and a selfie that are verified by a sophisticated AI algorithm

- The user associates themselves with one of the Bakong member banks

- From then on, they can use Bakong to buy and sell from participating merchants, or to send money to friends or family through P2P transfers

For individuals, Bakong serves as an e-wallet, enabling mobile payments and online banking. With a personal QR code, users can transfer money without sharing any personal information.

For merchants, the system processes cashless transactions with customers, other merchants, and their own bank. Merchants that accept Bakong can also be viewed in a map inside the app, and more than 500 merchants are now registered.

For banks, Bakong reduces the high fees for interbank transfers.

And for everyone, the system is reliable and fast. Transactions take less than 5 seconds, with system throughput exceeding 2,000 transactions per second. This is faster and more robust than the older system it replaced.

“With Bakong, we have been able to reduce development and maintenance costs, increase availability and resiliency, and mitigate the single points of failure, thus increasing overall security.”

“With Bakong, we have been able to reduce development and maintenance costs, increase availability and resiliency, and mitigate the single points of failure, thus increasing overall security,” says a spokesperson from the NBC IT Department.

“We plan to explore other use cases around blockchain, such as securities trading and digital identity. We believe that blockchain can bring numerous benefits such as improved data for statistical analysis, broadened access to digital services for the rural population, and reduced technology costs.”

The system should provide a big win for financial inclusion, especially for women.

“Because it is peer-to-peer in nature, every transaction is free of charge,” notes Serey. “This is especially empowering for women who will be able to earn and manage their finances from afar, and make sure their hard work is put to good use.”

What’s next for Bakong?

Bakong’s soft launch was a success, appreciated by individuals, merchants, and banks. Now the official country-wide launch of Bakong is scheduled to happen later in 2020.

“The NBC is putting together training for all the branches in Phnom Penh, and then expanding out the training from there into more rural areas,” says Takemiya. “This will happen after the official launch of the platform.”

The NBC working group will keep extending Bakong’s capabilities for retail payments, and it plans to explore additional business cases for financial markets.

For the future, they’re looking at features such as ATM withdrawals, term deposits, and tying into more traditional settlements.

New processes to support cross-border payments with Thailand and Malaysia are in the works, aimed at drastically reducing the costs of cross-border remittances. Eventually, people in these countries will only need to scan a QR code to send money to a family member in the neighboring country.

“We aim to improve financial inclusion, efficiency and safety, as well as promote the use of our local currency. We found that DLT could solve a lot of our problems.”

As the backbone of the payment system, Bakong connects customers, merchants, and financial institutions on a single secure and scalable platform. It has proven that a central bank can use a blockchain system with digital access to real money to modernize a payments system.

“We aim to improve financial inclusion, efficiency and safety, as well as promote the use of our local currency,” says Serey. “We found that DLT could solve a lot of our problems.”

Supported by Hyperledger Iroha, the NBC is one of the first central banks to begin clearing the path towards a CBDC. Perhaps others will learn from their example, and follow in their footsteps.

About Soramitsu

Soramitsu is a Japanese technology company delivering blockchain-based solutions for enterprises, universities, and governments. From the creation of domestic and cross-border payment systems, to the development of a forward-looking decentralized autonomous economy (DAE), our projects and use case studies represent the next-generation of fintech. To learn more, visit https://soramitsu.co.jp/

About National Bank of Cambodia

The National Bank of Cambodia (NBC), the nation’s central bank, is the monetary and supervisory authority. The mission of the NBC is to determine and direct monetary policy aimed at maintaining price stability in order to facilitate economic development within the framework of the kingdom’s economic and financial policy. As the monetary authority, the NBC is the sole issuer of the Khmer riel, the national currency. As the supervisory authority, the NBC has the authority to license, delicense, regulate and supervise banks and financial institutions in Cambodia. To learn more, visit https://www.nbc.org.kh/english/index.php

About Hyperledger

Hyperledger is an open source effort created to advance cross-industry blockchain technologies. It is a global collaboration including leaders in banking, finance, Internet of Things, manufacturing, supply chains, and technology. The Linux Foundation, the nonprofit organization enabling mass innovation through open source, hosts Hyperledger. The Linux Foundation also enables a worldwide developer community to work together and share ideas, infrastructure, and code. To learn more, visithttps://www.hyperledger.org/