How BondEvalue launched the world’s first fractional bond exchange with Hyperledger Sawtooth

As many industries struggled to find their footing amid the aggressive headwinds caused by the COVID-19 pandemic, the global bond market has managed to thrive.

With near-zero interest rates implemented worldwide to ease the financial burdens caused by the coronavirus, the demand for bonds soared with global bond issuances increasing 16% in 2020, according to S&P Global. By the third quarter of 2020, the International Capital Market Association valued the international bond market at a whopping $128.3 trillion.

But for those interested in investing in international bonds, the bond markets in Asia and Europe are particularly hard to break into for two reasons: high investment thresholds and lack of electronic infrastructure.

In the international bond markets, the minimum investment is $200,000. “This makes it inaccessible for even fairly wealthy people,” says Rajaram Kannan, co-founder and CTO of BondEvalue, a Singapore-based fintech company that focuses on Asian bond markets. Typically, only those who have $5 million or above can afford to diversify their portfolio, and they pour about one-third of their wealth into bonds.

But there are roughly 500 million people who are categorized as “HENRY”-s, or high earners not rich yet, who have assets that range from $100,000 to $1 million. This new class of investors is eager to expand their portfolio, yet they find the bond market impenetrable because of the high barrier to entry. “As a result, the liquidity in the bond markets is not even comparable to where the other capital markets are,” says Kannan. “The opportunity for growth is immense.”

Even when investors have the means to invest in the bond market, managing bonds can also be a challenge. “One of the pain points in the bond markets is that the trading still happens over phone calls,” explains Kannan. “If you’re a bond investor who wants to buy or sell bonds, you have to call up your relationship manager in your bank or brokerage and go from there. The workflows are not entirely electronic.” Another pain point in the bond market is the extra costs that accrue because of the number of intermediaries involved between the end investor and the actual market. Everyone takes their cut.

Until now! The team at BondEvalue recognized the need to upend the global bond market and create a modern infrastructure that makes managing bonds faster, more accessible, and more technologically advanced.

“At BondEvalue, our vision was a solution where investors can actually trade bonds on the go from a brokerage app just like they can trade in equity,” says Kannan.

In November 2019, BondEvalue launched the BondbloX Bond Exchange, replacing the traditional over-the-counter trading experience with the world’s first fully regulated blockchain-based bond exchange that allows consumers to instantaneously and transparently trade bonds in smaller denominations of $1,000 each.

Fully licensed and regulated by the Monetary Authority of Singapore as a Recognized Market Operator, the BondbloX Bond Exchange operates under a strategic partnership with Northern Trust, which is the global custodian partner for the exchange. Together they deliver integrated asset servicing and digital ownership of fractionalized fixed income bonds on a permissioned blockchain network. And from the beginning, the BondbloX Bond Exchange has attracted powerful players in the financial sphere who have signed on as launch partners such as UOB Kay Hian, one of the largest brokerage firms in Singapore.

“Asian bonds remain attractive to local and regional investors despite the global uncertainty and market downturn, and we are confident that this partnership will provide customers access to new sources of returns and opportunities to build a more diversified portfolio,” says Wilhem Lee, Senior Executive Director at UOB Kay Hian.

“We believe BondbloX will be an industry game changer,” says BondEvalue founder and CEO Rahul Banerjee. “Once investors have experienced BondbloX, they will take to online bond trading with the same fervor they do for equity trading.”

“BondbloX is the latest example of a groundbreaking application of blockchain technology in the capital markets enabled by experimentation in the MAS regulatory sandbox. We are excited to see productionalization of blockchain in the bond trading market and look forward to great adoption in transforming financial services.” 1

Powering the “Beast” with Hyperledger Sawtooth

“Exchanges are like big tech animals,” says Kannan. “They are beasts.”

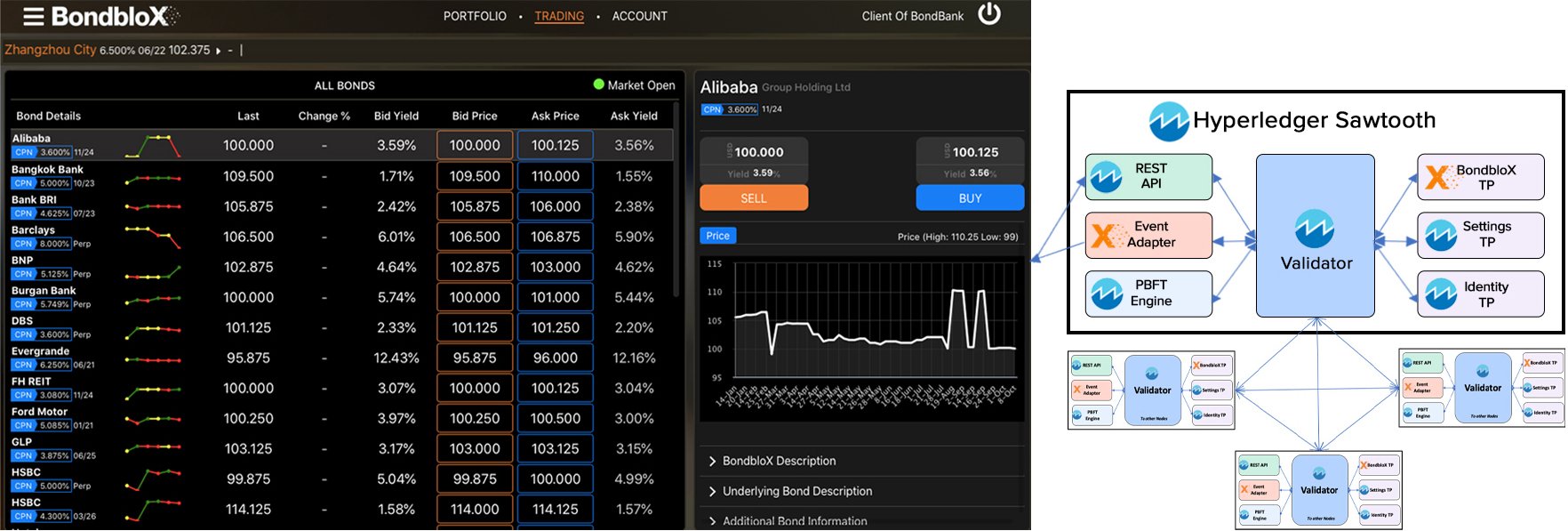

The BondEvalue team realized the only way to feed this beast and build an innovative, groundbreaking global bond exchange would be to deploy Hyperledger Sawtooth, the open-source blockchain framework hosted by the Linux Foundation. As a modular and flexible architecture, Hyperledger Sawtooth allows developers to separate the core system from the application domain so smart contracts can specify the business rules for applications without needing to know the underlying design of the core system.

“We are in the space where we need to own and build our own tech,” says Kannan. “And we have to give credit to the Hyperledger community and to the Linux Foundation for creating this framework and making our solution possible.”

Thanks to Sawtooth’s model, which uses a single node type, “the deployment is fairly simple. Even if somebody doesn’t host a node, it’s quite easy for anyone to sign and submit their transactions,” says Kannan. “If a bank already has a trading app and wants to connect to the BondbloX Bond Exchange, it is relatively easy using contemporary REST or Websocket APIs.”

Sawtooth also has rich support for standard and custom events, which helped to develop the distributed apps using an event-driven framework. Further, the permissioning framework was a great fit for creating a broad but closed network of approved participants.

Finally, the Practical Byzantine Fault Tolerance is “the perfect consensus” for the BondbloX Bond Exchange. “The reason for using blockchain is to create a trusted network, and we wanted the right protocol that allows for that,” says Kannan.

A Sawtooth PBFT network is permissioned and only an administrator can add or remove nodes.

This Hyperledger solution also offers a non-forking ledger consensus, which was a key factor in building the exchange. “We can’t tell people that their trade succeeded and then come back after 10 confirmations and say, ‘Oops, sorry, it didn’t work,'” says Kannan. “We needed a framework where when it’s committed, it’s done.”

As the BondbloX exchange continues to evolve, the team at BondEvalue remains committed to developing Sawtooth along with Hyperledger’s open source community. “We are looking at how we can contribute back. We have, in fact, made a couple of contributions that are in the process of being assessed by the community,” says Kannan. “We want to add value to the project.”

“Exchanges are like big tech animals. They are beasts. We are in the space where we need to own and build our own tech. And we have to give credit to the Hyperledger community and to the Linux Foundation for creating this framework and making our solution possible.” 1

How it Works: Lower Minimums, Higher Liquidity

The building blocks of the BondbloX Bond Exchange are the BondbloX themselves.

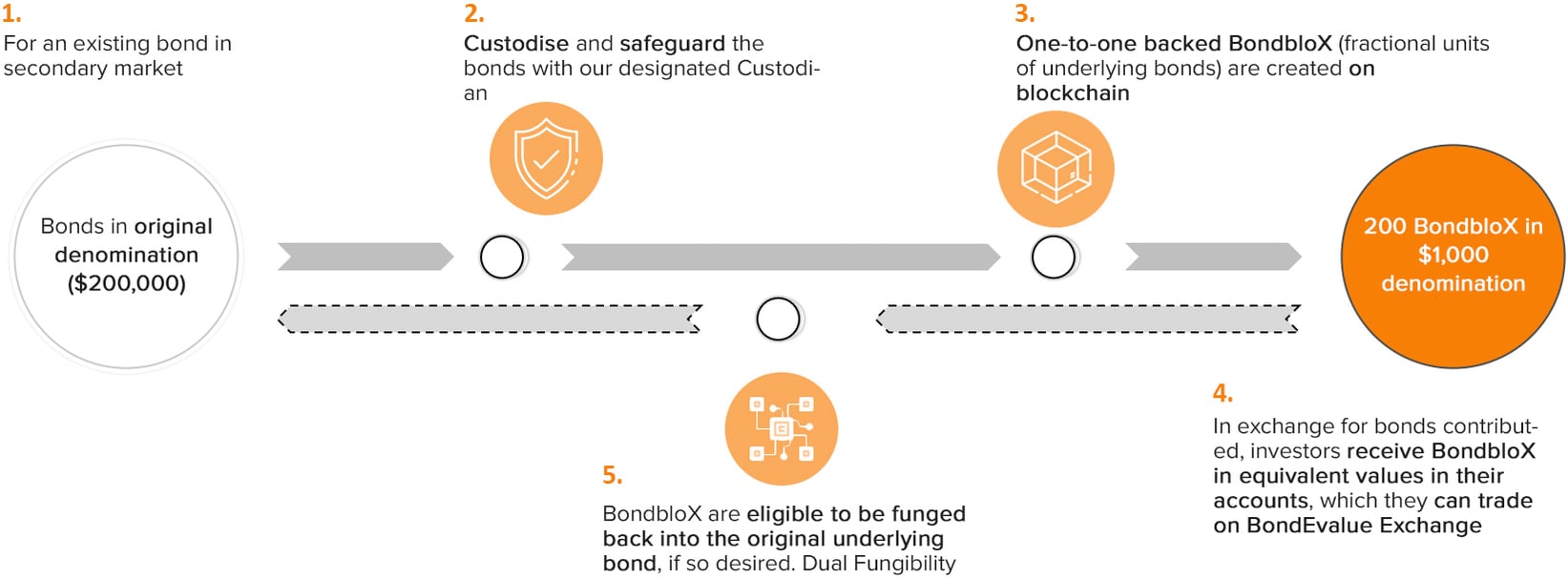

Using depository receipts as a model, traditional bonds are brought into the BondbloX Bond Exchange through designated market makers, member participants, or their end individual clients from the secondary market. A designated custodian on the exchange (in this case, Northern Trust) confirms receipt of the underlying bond into the blockchain, which then triggers the bond to be divided into fractionalized BondbloX worth $1,000 each and backed one-to-one on the blockchain.

“When a $200,000 bond comes in, the member receives $200,000 in BondbloX which is fractionalized into 200 BondbloX of $1,000 each and can be traded on the BondbloX Bond Exchange,” explains Kannan.

With the blockchain infrastructure, settlement on the BondbloX Bond Exchange is nearly instantaneous, occurring on a T+0 basis. So instead of waiting for the normal two-day settlement cycle for traditional bond transactions, BondbloX trades are final within seconds, reducing counterparty settlement risks for investors.

However, members who trade in BondbloX are not necessarily locked into the exchange. If a better opportunity in the secondary market arises, the BondbloX are “dual fungible.” Members can request via the custodian to withdraw the BondbloX from the exchange and deliver an OTC bond to a desired venue, which in turn reduces the quantity of BondbloX available to trade on the exchange. “It’s important that members feel that they’re able to take whatever investment opportunities are available to them,” says Kannan.

Ultimately, BondEvalue is confident that the best opportunity is to stay within the BondbloX Bond Exchange. “We believe as an exchange, because you’re able to sell at lower minimums, you’ll actually have a much more liquid market that more investors will be capable of investing and buying in,” says Kannan.

“We are excited to be working with BondEvalue to support a blockchain application that will broaden financial inclusion by opening up institutional bond markets to more investor types.” 1

Collaboration and Configuration

On the backend, “our governance model is collaborative,” says Kannan.

But there are strict rules of engagement for partners who are hosting nodes on the network. While BondEvalue is responsible for most of the work behind updating the nodes with new software, the governing council meets regularly to review upcoming releases and determine a date that is mutually beneficial so that all members can prepare for the updates.

“The main challenge is that each release has to be synchronized. Since we use all the nodes, they need to have the exact same software and the exact same version of the transaction process for the system to work as designed,” says Kannan. “If a partner hosting a node doesn’t upgrade, then they will go off chain.”

For the frontend, the BondbloX Bond Exchange is a cloud-native application hosted on AWS and accessible via distributed apps on the web. “Because of the event-driven framework that Sawtooth supports, we were able to create a completely asynchronous cloud-native environment that provides the same experience for investors and members that they are accustomed to when trading other exchange-based securities,” says Kannan.

To do so, the BondbloX app leverages IoT technology. “We integrated an IoT core solution so that we treat your browser like an IoT device that can deliver real-time notifications,” says Kannan.

To avoid committing personally identifiable information on the blockchain, the team also implemented an external database so that personalized user and client information sit outside the network while a pseudo-anonymized identifier is leveraged on the exchange.

“Within the blockchain, we had to make it really efficient for the transactions we process or the smart contracts we run, but outside the chain we can query in a really rich format” says Kannan. “So, you’re known by an anonymized ID in the blockchain. But then we merge that data with your real identity in the external database, and that information shows up in our app, which delivers a first-class user experience.”

The BondbloX exchange is regulated by the Monetary Authority of Singapore (MAS). After less than a year in the MAS regulatory sandbox — a construct in Singapore where fintech companies test their innovative financial service solutions in the marketplace but under regulatory scrutiny — BondEvalue’s blockchain-based bond exchange graduated after successfully concluding the proof of technology and business model in October 2020.

“BondbloX is the latest example of a groundbreaking application of blockchain technology in the capital markets enabled by experimentation in the MAS regulatory sandbox,” says Sopnendu Mohanty, chief fintech officer of the Monetary Authority of Singapore. “We are excited to see productionalization of blockchain in the bond trading market and look forward to great adoption in transforming financial services.”

Fractionalising bonds on blockchain (like Depository Receipts)

The Future of Financial Inclusion

When the BondEvalue team first introduced the BondbloX Bond Exchange, troubleshooting was at the forefront of their concerns.

“My biggest worry was what if, what if, what if …” says Kannan. “Today we have gone through all the scenarios and we know what to do if there are issues. We know what those issues are, and we know that they’re not going to bring us down.”

So, what’s next? Scaling the BondbloX exchange.

BondEvalue continues to engage more member participants such as Taurus Wealth Advisors, the leading fee-based, multi-family wealth management firm in Singapore, and Amstel, an institutional fixed-income broker with operations across Asia and Europe. BondEvalue is also expanding its footprint with a joint venture partnership in Mexico. The company’s goal is to empower a more diverse pool of investors and introduce them to institutional-grade opportunities in the bond market through its cutting-edge blockchain solution.

“We are excited to be working with BondEvalue to support a blockchain application that will broaden financial inclusion by opening up institutional bond markets to more investor types,” says Justin Chapman, global head of Market Advocacy & Innovation Research at Northern Trust.

“Our vision is to have over 25 million people in Asia invest in bonds in the next five years, from 500,000 individuals currently,” says Banerjee. “This is no small ambition, but we are hopeful as we have seen millions of people forced by COVID-19 lockdowns going online in the last six months for their everyday transactions.”

With the continued expansion of the BondbloX Bond Exchange, says Banerjee, “our vision of extending bond trading from Wall Street to Main Street is becoming a reality.”

Rich Interactive Trading DAPP!

Opening the on-ramp to the Digital Silk Road

Testing the first two projects for the Digital Silk Road began in late 2019 and they went live in January 2020.

“Before, the process was fragmented and repetitive,” says Waqas Mirza, CEO of Avanza. “Updates didn’t happen in real time. And it was hard to scale to add business units and authorities.”

With the Unification of Trade Registration, a company wanting to do business in Dubai can register once, through a secure, single-window interface. The data gets distributed across all government trade entities. And if the company needs to update any information, the new information is instantly shared by all.

Export Authorization tracks trade transactions, reduces transaction time, and enables secure, encrypted digital authentication. Seamless documentation sharing with relevant government entities happens through smart contracts. Compliance and regulatory checks happen throughout the process, which is completely paperless.

Export Authorization

“Dubai Chamber is proud to be the first chamber in the world to adopt and offer state-of-the-art blockchain solutions that simplify trade, improve ease of doing business and enhance economic competitiveness. This technology introduces plenty of far-reaching benefits for our members and regional partners, while it also has the potential to revolutionise the global trade landscape,” said HE Hamad Buamim, President & CEO of Dubai Chamber of Commerce and Industry and Chairman of the ICC – World Chambers Federation (WCF)

“With the new platforms, there is a seamless user experience,” says Ali Safri, Global Head of Presales and Innovations at Avanza Innovations. “All entities receive updates at the same time—there are no gaps in the data. And the entire system can scale easily and efficiently.”

Continuing on down the road

And the Digital Silk Road intends to scale up the system.

Additional blockchain networks to address other governmental processes are in the works, to further the Digital Silk Road’s registration and paperless processes. Smart contracts can move data from one platform to another.

Speaking about the Digital Silk Road strategy, Buamim said: “We have been able to develop a project that is aligned with the vision of the initiative and meets Dubai’s need for a platform that facilitates more cost-efficient, safer and faster trading. We can avoid all obstacles and unnecessary procedures and enhance our role as a trading chamber by using the latest technologies such as blockchain.”

In the future, the Digital Silk Road will make cross-chain connections with complementary platforms that handle trade financing, private business directories, and personal digital services.

Staying 10 years ahead of other world cities is an ambitious plan. With the help of Avanza and Hyperledger Fabric, Dubai has a solid foundation to support a modernized, digital marketplace and trade center. And the Digital Silk Road will bring Dubai closer to its 10X destination.

About BondEvalue

BondEvalue is a Singapore-based fintech that has been changing the Asian fixed-income markets since 2016. The founders have decades of leadership experience in debt markets, on both the business and the technology side. BondEvalue brings innovation to bond price discovery, AI-based news, analytics, and delivers these services via mobile, web, and APIs. In November 2019, BondEvalue unveiled the world’s first blockchain-based bond exchange that allows investors to trade BondbloX, which are $1,000 fractions of traditional wholesale bonds. The platform operates on a B2B2C model and connects to the end investor via their bank or broker. Please visit bondevalue.com for further information.

About Hyperledger

Hyperledger is an open source collaborative effort created to advance cross-industry blockchain technologies. It is a global collaboration including leaders in finance, banking, Internet of Things, supply chains, manufacturing and Technology. The Linux Foundation hosts Hyperledger under the foundation. To learn more, visit https://www.hyperledger.org